The Man Who Turned Down 20% of Apple Stock: The True Story of Regis McKenna

Who turned down 20 percent of Apple stock How much would 20% of Apple be worth in 2025 Why did Regis McKenna say no to Apple What was Regis McKenna’s role at Apple Did Steve Jobs offer Apple stock to consultants What companies did Regis McKenna work for How Apple first marketed its personal computer

who turned down Apple stock, Regis McKenna Apple story, Apple 20 percent stock offer, biggest mistake in tech history, Apple marketing 1976, how much 20 percent of Apple is worth, Apple early history for beginners, true story of Regis McKenna and Apple .

By YEET Magazine Staff, YEET Magazine

Published October 3, 2025

The Man Who Turned Down 20% of Apple Stock: The True Story of Regis McKenna

“I was looking at my cash flow. That’s one of the reasons I turned down Apple’s offer.”

— Regis McKenna (Wikipedia)

The True Story Behind One of Silicon Valley’s Most Expensive Decisions

If you’ve ever wondered, “Who turned down Apple stock and lost billions?” — this is that story.

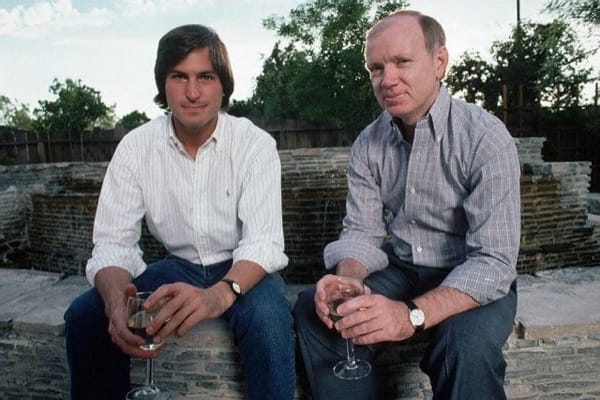

In the mid-1970s, Apple Computer was a tiny startup run by two young visionaries, Steve Jobs and Steve Wozniak, working out of a garage in Los Altos, California. They needed help turning their handmade computer into a real product.

So they reached out to Regis McKenna, a Silicon Valley marketing expert already known for helping small tech companies become big names.

Jobs offered McKenna something unusual: instead of cash, 20 percent of Apple’s stock.

McKenna, managing his own small agency and needing cash flow to pay employees, politely declined.

He chose security over speculation.

That single choice — captured in a letter now reportedly displayed at Apple’s headquarters — has become one of the most famous “what ifs” in business history.

Why Regis McKenna Said No to Apple’s 20 Percent Offer

In 1976, Apple had no real revenue, no guaranteed future, and no proof the personal computer would even catch on.

Jobs and Wozniak believed their product could change the world, but McKenna had to pay bills, keep his staff working, and cover rent. “I was looking at my cash flow,” McKenna later said.

He turned down 20% of the company and asked to be paid in cash instead.

At the time, Apple’s stock was worthless. Today, that same share would be worth over $500 billion.

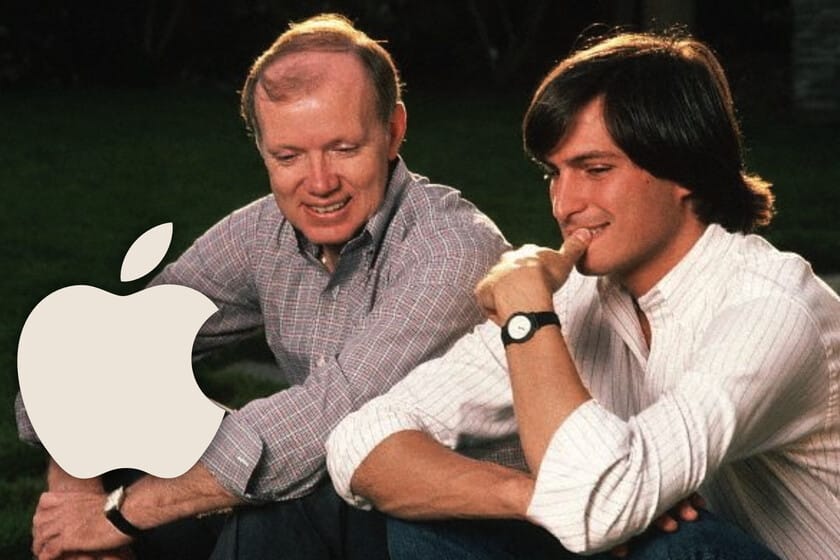

How Regis McKenna Helped Build Apple Anyway

Even though he turned down the stock, McKenna didn’t walk away. He agreed to help Jobs and Wozniak launch the Apple II, Apple’s first successful consumer computer.

He helped them craft their first press releases, design marketing materials, and build credibility in the growing tech world.

McKenna also shaped how Apple communicated with customers — focusing on emotion, design, and simplicity.

“Apple learned to connect technology with feelings,” he said years later. “That’s what made people care.”

That mindset still drives Apple’s brand today.

How Much Would 20% of Apple Be Worth Today?

People often Google: “How much is 20 percent of Apple worth?”

As of 2025, Apple’s market value sits around $2.6 trillion. Twenty percent of that would equal roughly $520 billion — making Regis McKenna one of the richest people in the world if he had accepted.

But back then, no one knew Apple would even survive. For McKenna, it wasn’t a missed opportunity — it was a logical decision in the moment.

This story shows how timing, context, and necessity shape every business decision.

What We Can Learn from Regis McKenna’s Apple Story

This is more than a story about money — it’s a story about choices.

- Cash flow matters. You can’t run a business on future promises.

- Equity is a gamble. It’s only valuable if the company succeeds.

- Vision doesn’t always pay today. Sometimes, security wins the day.

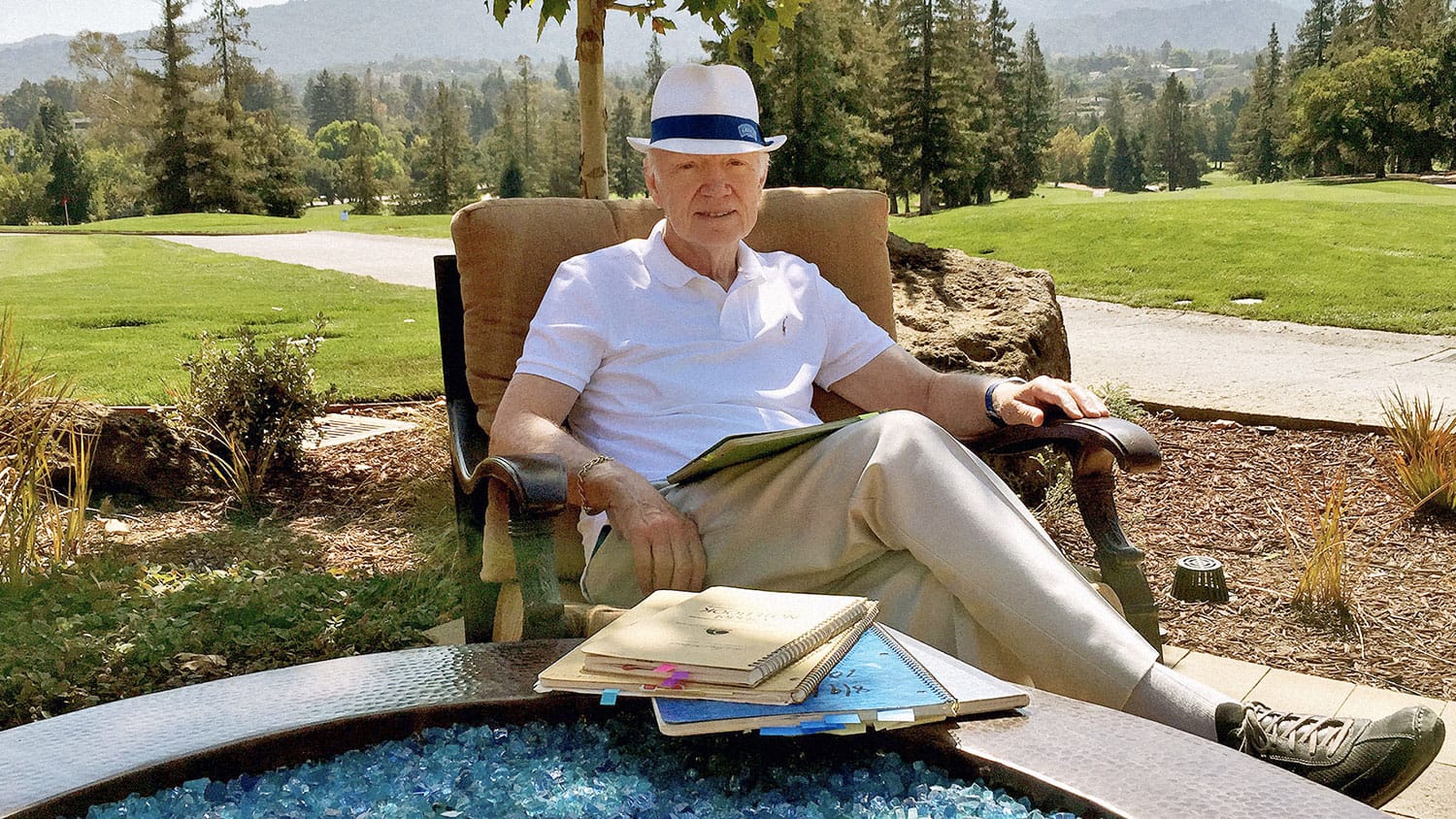

- Regret doesn’t define you. McKenna went on to advise Apple, Intel, and Genentech — shaping the way tech is sold to this day.

The letter he wrote declining Apple’s offer has become a kind of moral compass for entrepreneurs: do what you must to stay alive, but never stop believing in your ideas.

Why This Story Still Matters in 2025

In today’s startup culture — where stock options, tokens, and equity deals dominate — McKenna’s story hits differently.

It reminds founders, freelancers, and consultants to balance survival with potential reward.

Yes, McKenna lost a fortune. But his influence helped make Apple’s success possible.

And in Silicon Valley, that’s its own kind of wealth.

Summary

Regis McKenna, a Silicon Valley marketing consultant, was offered 20 percent of Apple’s stock in 1976 instead of cash. He turned it down because he needed immediate income to keep his business running. That stock would now be worth over $500 billion. Despite declining, McKenna helped Apple launch its first personal computer and shape the company’s early marketing strategy.

Relate posts

- Who turned down 20 percent of Apple stock

- How much would 20% of Apple be worth in 2025

- Why did Regis McKenna say no to Apple

- What was Regis McKenna’s role at Apple

- Did Steve Jobs offer Apple stock to consultants

- What companies did Regis McKenna work for

- How Apple first marketed its personal computer

- Why cash flow matters for startups

- What are examples of missed billion-dollar deals

- Who helped Steve Jobs market Apple II

- How did Apple advertise in the 1970s

- What is Regis McKenna known for in Silicon Valley

- What is the biggest business mistake in tech history

- How Apple built brand trust and identity

- Lessons from people who turned down fortune

- How Apple’s early PR changed the tech world

- When did Apple first become profitable

- Did Apple ever offer stock to outside consultants

- What can entrepreneurs learn from Regis McKenna

- What is the real story of Apple’s first marketing consultant